Annual

Review

2024

(COPY)

Foreword

2024 has been a really busy second full year of operation for the Centre as this year's Annual Review shows.

We've engaged with a wide range of audiences, in person and online, across a wide variety of events both ones we've organised (including our third annual Personal Financial Wellbeing Research Conference in November - held jointly again with the UK Government’s Money and Pension Service) and ones we've been invited to speak at. We list many of these activities in the ‘Our events in 2024’ section below.

We have completed and started a number of projects and we have seen significant growth in the size of the team that makes up the Centre’s membership – particularly growth in our Associate Membership (now 21 members strong). To be an Associate member of CPFW you have to not only have a shared interest in our work, but also be actively working with us on one of our various projects and so this membership growth follows the breadth of new activities we have engaged in over the year some of which you will see detailed in this annual review.

In the year, we also welcomed three new research students in Sedinam, Shuayb and Chris to our Centre who, between them, bring further international perspectives to our work as they join us from Ghana, Somalia and Canada. Details of their specific projects can be found below, along with videos from two of them explaining their exciting plans. These include developing new perspectives on measuring and assessing changes in financial wellbeing, going deeper into what financial wellbeing means in practice to those moving between countries and into the basis for financial wellbeing development amongst small businesses.

We are hugely grateful to our financial supporters who back our projects and enable us to undertake the work we do. New to this group this year are the Aviva Foundation (supporting our EMPOWER project), Fair4All Finance (via our work with NEST Insight) and the British Academy (via its support of Hayley’s BA Innovation Fellowship that commenced in the autumn of 2024). We are also most grateful for the ongoing support of our host institution, Aston University, who provided core funding for the Centre’s operations throughout this last year.

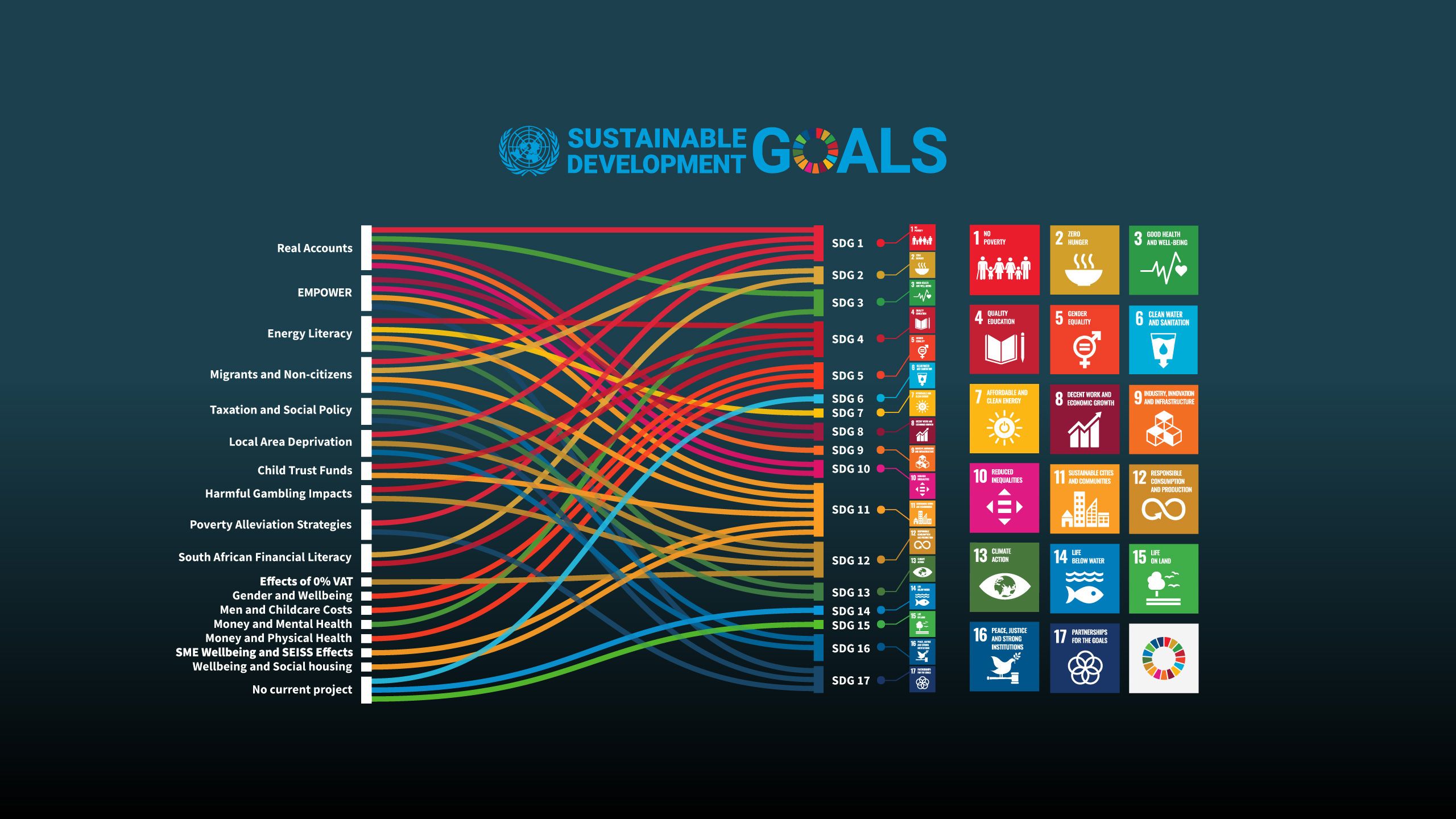

You will also see included in the Review a graphic detailing how our various current , or recently completed, projects connect with the UN's Sustainable Development Goals (SDGs). A key underpinning principle of our work is to ensure we are playing our part to contribute to meeting these critical goals for a fairer and more equal world.

As we start 2025 we are excited by the plans we have to bring several projects to a conclusion, to share results from that work and to launch several new ventures. Do please join our various socials to get first sight of the details on those activities as they are ready to be shared.

We’d very much welcome contact from anyone with a shared interest in the area of personal financial wellbeing – do please reach out to us if you have project ideas or a desire to work with us in any capacity. We’d love to hear from you.

Professor Andy Lymer

Director - Centre for Personal Financial Wellbeing

Who we are

Our core team

The people behind the Centre for Personal Financial Wellbeing

Prof Andy Lymer

Centre Director and Professor of Taxation and Personal Finance

Key research areas

personal finance

taxation

social policy

small businesses

poverty alleviation

financial education

Dr Hayley James

Senior Research Fellow

Key research areas

household finance

pensions

gender and financial services

money and mental wellbeing

ageing societies

young people

Dr Lin Tian

Research Associate

Key research areas

household finance

financial inclusion

labour and health economics

deprivation and financial wellbeing

intergenerational transfer of wealth

energy literacy

Dr Halima Sacranie

Research Fellow

Key research areas

housing and communities

social and affordable housing

harmful gambling

financial inclusion

housing and neighbourhood quality

sustainability

Thea Raisbeck

Visiting Research Fellow

Key research areas

homelessness

supported housing

financial inclusion

young people

Dixon Wong

Centre Manager

Key duties

administration

website

social media

budgeting

events

liaison

Christopher Gorman

Research Student

Key research areas

owner-manager businesses

financial planning

small business financing

Sedinam Ameku

Research Student

Key research areas

financial wellbeing measurement

financial literacy

financial education

Shuayb Mohamed

Research Student

Key research areas

Migrants and financial wellbeing

Associate Members

Dr Amir Allam

Senior Lecturer in Accounting,

Aston University

Working with the Centre on quantitative analysis of financial wellbeing.

Dr Anne Angsten Clark

Lecturer in Design Thinking and Innovation, University of Bristol

Working with the Centre on the Real Accounts project.

2024 publication examples: Beyond individual responsibility – towards a relational understanding of financial resilience through participatory research and design | Journal of Social Policy | Cambridge CoreDr

Dr Ariane Agunsoye

Senior Lecturer in Economics, Goldsmiths, University of London

Working with the Centre on gender and financial services.

2024 publications examples: Lived experiences of everyday financialization: A layered performativity approach

Rethinking Financial Behaviour: Rationality and Resistance in the Financialization of Everyday Life

Prof Bernadene de Clercq

Professor, University of South Africa

Working with the Centre on financial literacy and wellbeing projects in South Africa.

Carla Hoppe

Founder at Wealthbrite

Working with the Centre on young adults and money skills.

Dr David Hayes

Independent Research Consultant

Working with the Centre on quantitative analysis of financial wellbeing.

Dr Emily Christopher

Lecturer in Sociology, Aston University

Working with the Centre on the men and childcare project.

Dr Gary Burke

Associate Professor of Strategy and Organisation, University of Bristol Business School

Working with the Centre on poverty alleviation strategies.

Dr Heather Kappes

Associate Professor (Education) in Marketing, London School of Economics and Political Science

Working with the Centre on subjective financial wellbeing measurement and assessment.

Dr Hussan Aslam

Assistant Professor Research,

Coventry University

Working with the Centre on the EMPOWER project.

Jo Phillips

Director of Research and Innovation,

Nest Insight

Working with the Centre on the Real Accounts project.

Dr Juan J. Fernández

Associate Professor of Sociology,

University Carlos III of Madrid

Working with the Centre on retirement and financial wellbeing.

Dr Kanimozhi Narayanan

Lecturer in Organisational Behaviour,

Aston University

Working with the Centre on the financial effects of harmful gambling.

Dr Katie Tonkiss

Senior Lecturer in Sociology and Policy,

Aston University

Working with the Centre on non-citizens and personal finance.

Dr Mahmoud Elmarzouky

Associate Professor of Accounting,

University of St Andrews

Working with the Centre on quantitative analysis of financial wellbeing.

Prof Monder Ram

Professor of Small Business & Director of Centre for Research in Ethnic Minority Entrepreneurship, Aston University

Working with the Centre on the EMPOWER project.

Dr Ngoc Dieu Linh Vi

Lecturer in Economics,

Aston University

Working with the Centre on deprivation and financial wellbeing.

Prof Olga Biosca

Professor of Economics,

Glasgow Caledonian University

Working with the Centre on the Real Accounts project.

Dr Omid Omidvar

Associate Professor in Organisation Studies,

University of Warwick

Working with the Centre on poverty alleviation strategies.

Dr Saidul Haque Saeed

Lead Organiser, Citizens UK

Working with the Centre on the EMPOWER project.

Prof Sally Dibb

Professor of Marketing and Society,

Coventry University

Working with the Centre on the EMPOWER project.

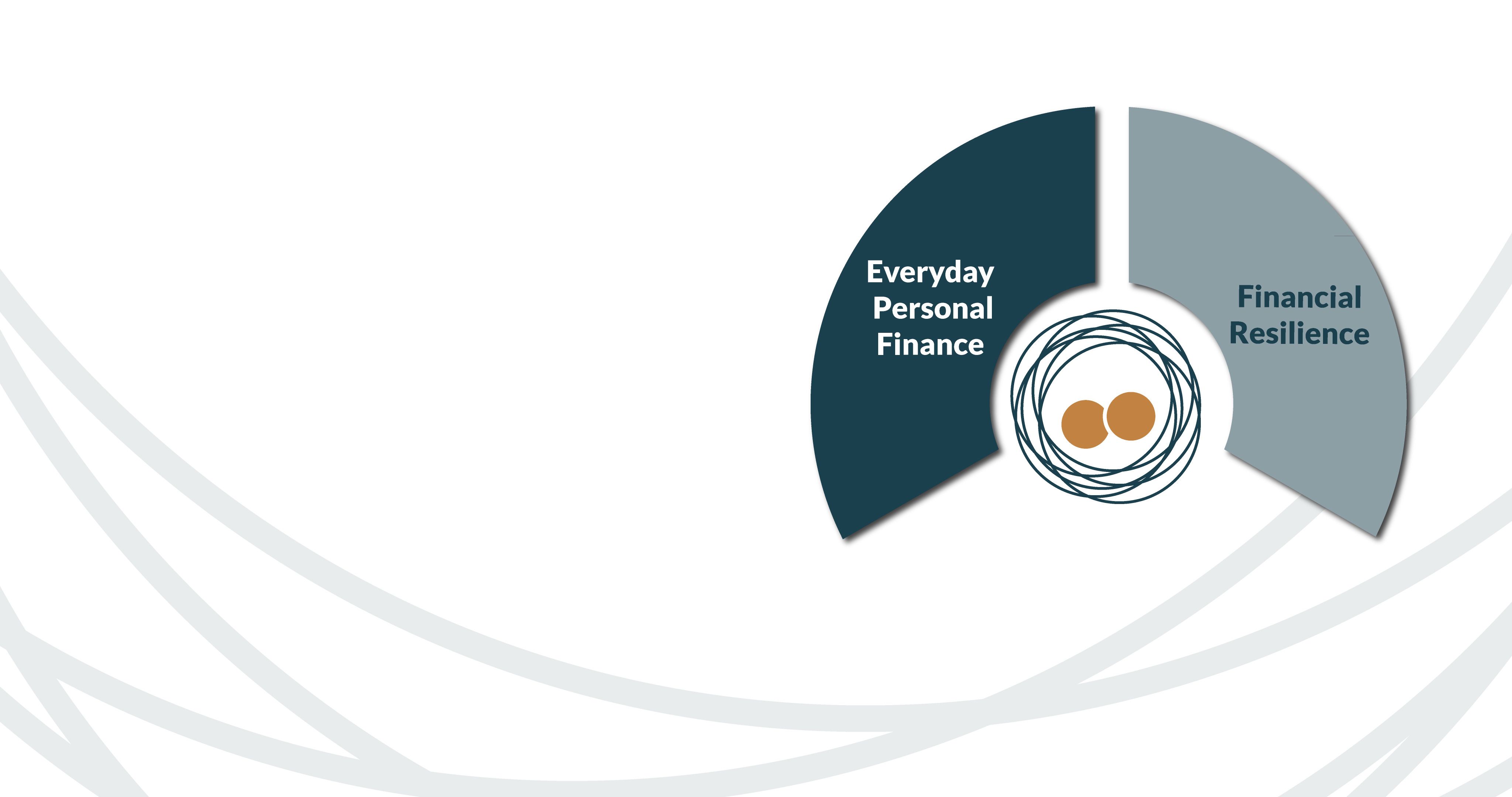

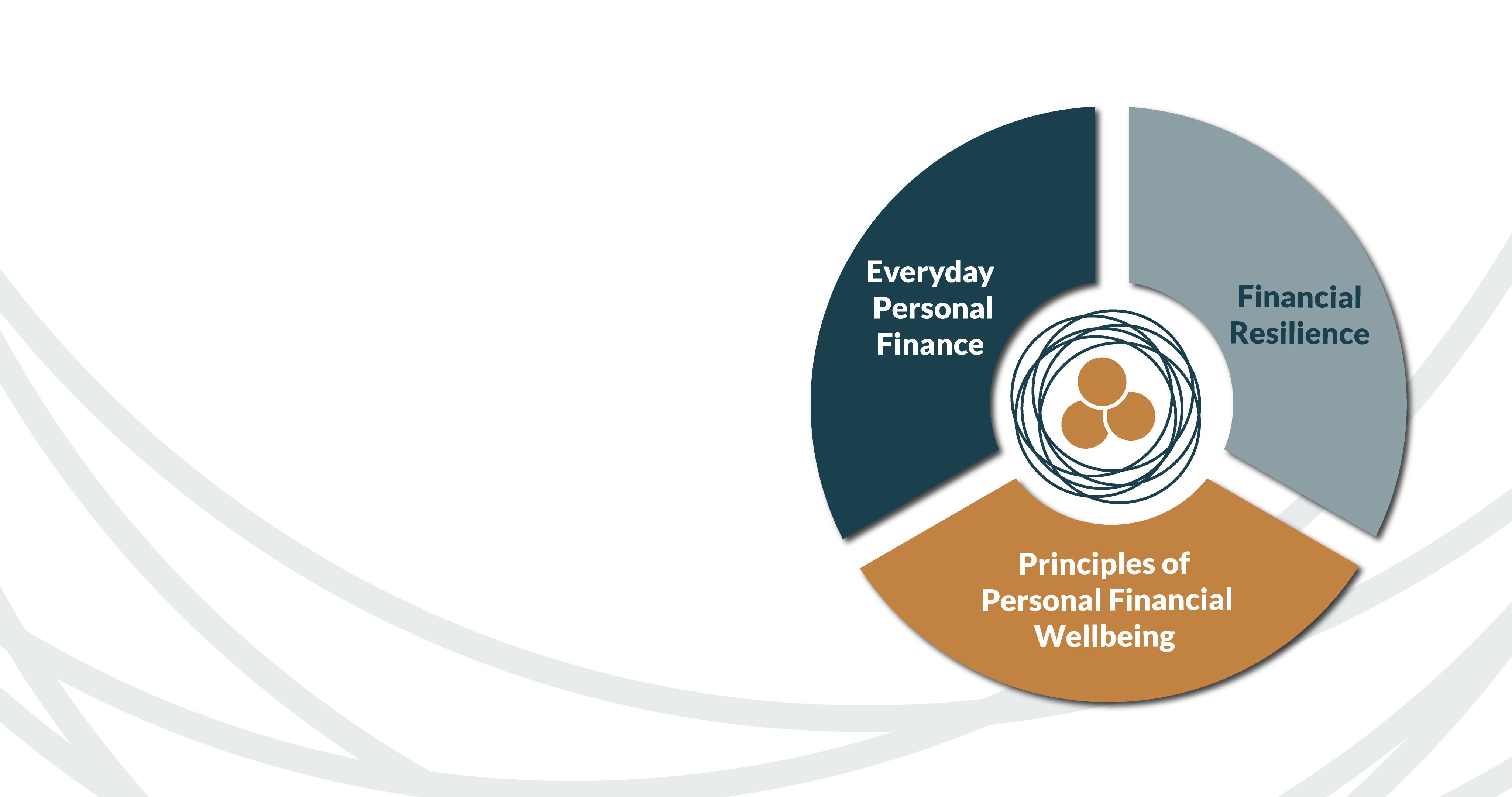

Our Research Focusses

Centre’s research is focussed around three key themes:

Everyday Personal Finance

Our research in this area explores what personal financial wellbeing means for different parts of society, understanding the lived experience of finance in everyday life across socio-demographic axes. This includes: exploring the experiences of people living on lower and on volatile incomes, the impact of migration on financial wellbeing, the effects of mental and physical health on financial wellbeing, and financial implications of decisions such as whether to be an employee or work for yourself.

Creating Financial Resilience

Our research in this area seeks to improve our understanding of how to balance spending and savings, over the short and longer terms, and how to facilitate the development of a ‘nation of savers’. We look at both common and alternative approaches to developing and maintaining saving strategies. Our work explores effective savings support for those on lower incomes and in precarious work, those who run small businesses, and those affected by migration and displacement.

Principles of

Personal Financial Wellbeingeing

Our work also seeks to explore the underpinning and underlying principles of personal financial wellbeing. We examine issues such as how can financial wellbeing be best conceptualised to enable its effective development in practical ways. We study how the results of change from different interventions can be measured and assessed reliably. We look at the implications of viewing financial wellbeing in different ways to aid its positive impact on people’s lives.

Our impacts in 2024

Number of people who

participated in our events or events we spoke at in 2024

Number of organisations

we worked with in 2024

Number of events we

have presented at in 2024

Number of reports / research / books published in 2024

Number of people we've

engaged with online in 2024

Total funding raised

for active projects in 2024

What are we working on now?

Professor Andy Lymer

Poverty Alleviation Strategies

Harmful Gambling and Tenancy Loss

EMPOWER

Dr Hayley James

Dr Emily Christopher

Thea Raisback

Homelessness and Supported Housing

Chris Gorman

Sedinam Ameku

Our events in 2024

The Directors Club

Prof Andy Lymer addressed "Economics in Adversity" at the Director's Club of Aston Business School, outlining the extent of the crisis we are now living through in figures and laying out how the Centre's research work seeks to make a difference during these difficult times.

World Economic Forum

Dr Hayley James attended the Longevity Economy workshop in Brussels - hosted by the World Economic Forum . This event provided an opportunity to share her work and to engage in many interesting and important discussions about how we adapt to the longevity revolution in ways that help everyone have a more positive experience of later life.

Economic Justice Action Network

Prof Andy Lymer took part in the Economic Justice Action Network meeting organised by the Barrow Cadbury Trust. During this event Mary-Ann Stephenson of the UK's Women's Budget Group addressed gender and economic injustice in the UK. The group explored what actions could be taken to make a difference to the significant gender imbalance that exists in the UK.

James Timpson OBE Visit

For the second occasion, Prof Andy Lymer hosted James Timpson OBE DL , CEO of the Timpson Group, (then a Visiting Professor of Aston Business School - now the UK's Minister of State for Prisons, Probation and Reducing reoffending), for a full day of activities with students and staff.

HSBC Financial Education for Young People in Birmingham

Prof Andy Lymer attended a round table event discussing the future for financial education for young people in Birmingham, hosted by HSBC UK and Councillor Sharon Thompson.

Research Retold Book Launch

Prof Andy Lymer contributed to a new book The Guide to Communicating Research, authored by Mihaela Gruia, a UK based research communications expert, and published by her business Research Retold. Centre Manager Dixon Wong joined the book launch to represent the Centre who regularly work with Mihaela and her great team to develop clear and accessable messaging of their research.

Dr Ariane Agunsoye presenting at CHASM webinar

In an online seminar hosted by Centre on Household Assets and Savings Management (CHASM) our Associate member Dr Ariane Agunsoye presented key insights from her recently published paper “Irrational or Rational? Time to Rethink Our Understanding of Financially Responsible Behavior” co-authored with our researcher Dr Hayley James .

The Centre presenting latest project findings to MaPS

The Centre presented three of our recent Money and Pensions Service (MaPS) funded pieces of work to their staff at a dedicated internal review session, discussing the relationship between money and people's health (mental and physcial), as well as how living in deprived areas affects people's financial wellbeing.

Social Policy Association Conference

The Centre presented, organised and co-organised four symposia and four paper sessions at the Social Policy Association's Annual Conference hosted by University of Strathclyde in Glasgow.

EMPOWER networking lunch meeting

As part of a 2-year project started this year, our EMPOWER project team organised the first (of five) local networking lunches with business owners of ethnic minority-led organisations, hosted by Aspire & Succeed in the heart of the Lozells neighbourhood in Birmingham. Participants included a mix of businesses from different backgrounds exploring the challenges they faced in creating a better future for their families & community.

Wychavon Poverty Alleviation workshop

Prof Andy Lymer, Dr Gary Burke and Dr Omid Omidvar organised a poverty alleviation strategies workshop for the Wychavon District Council. Both the Council's staff and the leaders of the various third and voluntary organisations in attendance unpacked together the challenges of addressing poverty on the ground and what more could be done to remove barriers to work closer in future.

Nest Insight Annual Conference

Prof Andy Lymer and Dr Hayley James joined the Nest Insight annual conference in London to explore the latest research on lifelong financial security for households - including featuring our work together on the Real Accounts project, looking into incredible short term, flexible, pressures faced by those UK households on volatile incomes to deal with their everyday finances.

Finance and Society Conference

Dr Hayley James presented her paper on Masculinities in Asset Accumulation for Later Life, co-authored with our associate member Dr Ariane Agunsoye at the Finance and Society conference at the University of Sheffield.

Tax Research Network Annual Conference

As Chair of the international Tax Research Network, Prof Andy Lymer was involved in helping to lead the Network's 2024 Annual Conference hosted at Cardiff University, alongside local host team of Prof Carla Edgley, Dr Dennis De Widt, Nicky Thomas (University of Exeter) and Terry Filer (Swansea University).

Gambling Commission Report

Along with our research partner lead, Helen Shervington from Birmingham City Council, Dr Halima Sacranie presented at a national Gambling Commission event the findings from our 2-year research project on Harmful Gambling and Tenancy Insecurity .

EMPOWER project – Women business leaders meeting

Our EMPOWER project team worked with Saathi House to organise a community event to gather some women business leaders from ethic minority background to share their journey in entrepreneurship and the issues they have faced and overcome.

Research Retold Poster Design Workshop

Research communications expert Mihaela Gruia from Research Retold delivered an online poster design workshop for researchers who have expressed interest in submitting a poster to our Personal Financial Wellbeing Research Conference this year, as well as aspiring postgraduate students and academics across the Aston Business School.

Independent Social Research Foundation (ISRF) workshop on intersectional financial risk

Dr Hayley James, Dr Ariane Agunsoye and Prof Kate Padgett Walsh ran a workshop on Intersectional Financial Risk at Goldsmiths, University of London.

The UK Budget interview

In an Aston University podcast interview immediately following the 2024 UK Budget statement from Parliament, Prof Andy Lymer reflected on the key tax changes and other announcements that will affect personal financial wellbeing .

Personal Financial Wellbeing Research Conference

The Centre co-hosted with the UK's Money and Pensions Service their third annual conference on 13th November at Aston Business School. The day included three panel sessions discussing:

- our poverty alleviation strategy research work with district councils, voluntary and third sector organisations

- the shapes and forms of personal fraud in today's society and how to avoid becoming a victim of fraud, and

- results and reflections from the nation-wide financial diaries project Real Accounts

The day also included an extended poster session during lunch where other research projects the Centre is engaged with, and those of other organisations, were showcased.

The Purse Podcast

Dr Hayley James was invited to join The Purse Podcast to explore how finance intersects with gender, family, and societal norms, as well as what needs to change to make financial systems truly inclusive.

Aviva Foundation Partner Learning Day

Prof Andy Lymer and EMPOWER team members Prof Sally Dibb and Dr Hussan Aslam attended the Aviva Foundation Partner Learning day with others who also have projects supported by the Foundation - sharing experiences of building financial resilience in communities.

Fluctuation Report Launch

Over a week in November, the Real Accounts end of project report (Fluctuation Nation) was launched across several events to a wide variety of audiences. This included a launch event in the UK Parliament hosted by Torsten Bell MP (Parliamentary Under-Secretary of State for Pensions) and Dr Hayley James presenting in a webinar alongside Dr Anne Angsten Clark.

The report explores the key findings from the Real Accounts project providing evidence of the UK's ‘volatility premium’ and other work from this extended study of what it takes to live on a volatile income in the UK in 2024 - undertaken with our partners, NEST Insight and the Yunus Centre for Social Business and Health (Glasgow Caledonian University).

University of South Africa Presentation

As part of a trip to South Africa, Prof Andy Lymer, joined online by Dr Lin Tian, presented our financial wellbeing segmentation analysis of South African consumers (jointly undertaken with colleagues from the University of South Africa, including Prof Bernadene de Clercq) to the Financial Services Conduct Authority of South Africa, the National Treasury of South Africa, as well as researchers and other practitioners working in this field.

Opening the 26th Workshop on Accounting and Finance in Emerging Economies

Discussing our work with colleagues on South African consumers' financial wellbeing, Prof Andy Lymer provided the opening speech to the 26th Workshop on Accounting and Finance in Emerging Economies, hosted at Aston University. Organised by the British Accounting and Finance Association's Emerging Economies Special Interest Group, this annual workshop aims to bring together academics working in this area to increase awareness of contemporary issues and cutting-edge research being undertaken on accounting and finance in these economies.

Projects Highlights

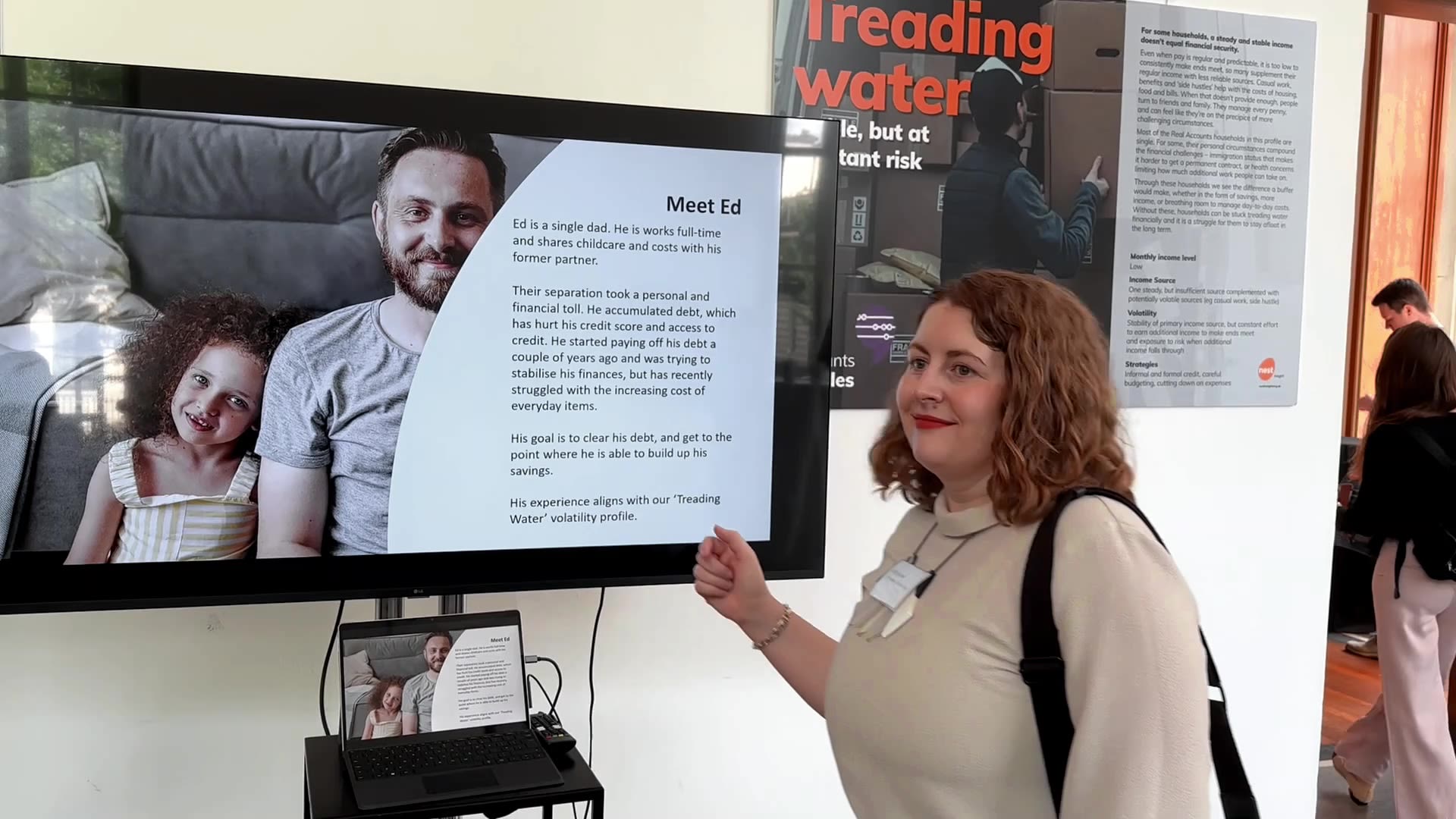

Real Accounts

A national financial diaries project

Real Accounts is a collaborative 10-month financial diaries study led by Nest Insight with the Centre for Personal Financial Wellbeing at Aston University and the Yunus Centre at Glasgow Caledonian University. Data collection for the project was completed in 2023 – 2024 and findings point to the ‘volatility premium’, which adds extra costs and strain into managing finances for millions of people in the UK who have a volatile income, and the strategies that people use to overcome with financial challenges.

The financial diaries methodology used in the research was instrumental to lift the lid on their experiences and recognise the pinch points that contribute to the volatility premium. The programme of work calls for a combination of inclusive policy design, employer initiatives, financial sector reforms, and community support. You can find the reports from the project at the Real Accounts programme page.

Our Senior Research Fellow Hayley James also designed a financial diaries toolkit as a result of the project. For those interested in employing the methodology please take a look: Real Accounts Toolkit.

Financial Education in South Africa

International collaboration to improve global financial wellbeing

As an Honorary Professor in the Department of Taxation at University of South Africa (UNISA), Prof Andy Lymer has been working with UNISA's Professor Bernadene de Clercq and her team to provide a segmentation analysis of recent country wide financial capability assessment data for the South African government, with an aim to support wider financial wellbeing understanding and thereby help to best target resources to the maximum benefit across the population.

After months of in-depth analysis and exploration led by Dr Lin Tian, the team presented their findings on the financial wellbeing of South African consumers to the Financial Sector Conduct Authority and National Treasury of South Africa during a trip to the country in November 2024. Exciting updates on the next phase of this impactful work are expected in 2025.

Poverty Alleviation Strategies

Regional work to facilitate councils develop intervention strategies

In 2022 the Centre started working with Malvern Hills District Council to aid their development of regional poverty alleviation strategies. Utilising the principles and practice of addressing wicked challenge of poverty, the project looks at how strategies are formed, how the wicked challenges are examined within the authorities themselves, and how they work in conjunction with their various public, voluntary/charity and third sectors partners.

This project to date has included running and supporting multiple workshops and interviews, created several reports and the development of a operational toolkit now being tested. Various practical impacts have been created from this project benefitting the most vulnerable residents in Malvern and the organisations who work with them.

The project is in collaboration with two of the Centre's Associate Members working at the University of Bristol and the University of Warwick. Going into 2025, the team is now working with other councils in Worcesershire and beyond to extend this work further.

EMPOWER

Ethnic Minority-led Private Organisations' Wellbeing, Entrepreneuship and Resilience

The Centre kicked off a 2 year project in 2024 in conjunction with the Aston Centre for Research in Ethnic Minority Entrepreneurship (CREME), the Centre for Business in Society based at Coventry University and Citizens UK, looking into the myriad of ways in which ethnic minority-led businesses make decisions about their finances that enable them to launch well and survive into steady state.

Leveraging the networks of CREME and Citizens UK, the team have recruited over 30 businesses from a series of community meetings. At the end of 2024, interviews are underway to explore with them the complex interactions between personal and household finances and entrepreneurial financing. An expert panel has been formed to guide co-design workshops.

Funded by Aviva Foundation, the project will produce systematic interventions to support future ethnic minority-led businesses more effectively in growing their financial resilience as well as drive related policy change, going into phase 3 in 2025.

Supporting UN SDGs

How CPFW's research supports the

UN Sustainable Development Goals

Appendix: list of projects

Current Projects

• Effects of SEISS Payment on Entrepreneurship

• Men and Childcare Costs

• EMPOWER - Ethnic Minority-led Private Organisations'

Wellbeing, Entrepreneurship and Resilience

• Energy Literacy in the UK

• Poverty Alleviation Strategies – Addressing Wicked Challenges

in Personal Finance

• 0% VAT Rate – Exploring Who benefits

• Gender and Financial Wellbeing

• Development of Financial Education and Financial wellbeing in

South Africa

• Financial Planning for Owner-Managers

See further details on these active projects on our website - www.aston.ac.uk/cpfw

Recently Completed Projects

• Real Accounts

• Harmful Gambling and Tenancy Loss

• Money and Health

• Migrants and Non-citizens

• Taxation and Social Policy

• Local Deprivation and Personal Financial Wellbeing

• Child Trust Fund

• Social Housing and Personal Wellbeing

Full details of the outcomes and outputs of these projects can be found on our website

Contact us

Contact us

Find out more about us, and follow our work at ...

© Aston University 2025