Annual

Review

2023

Foreword

Professor Andy Lymer

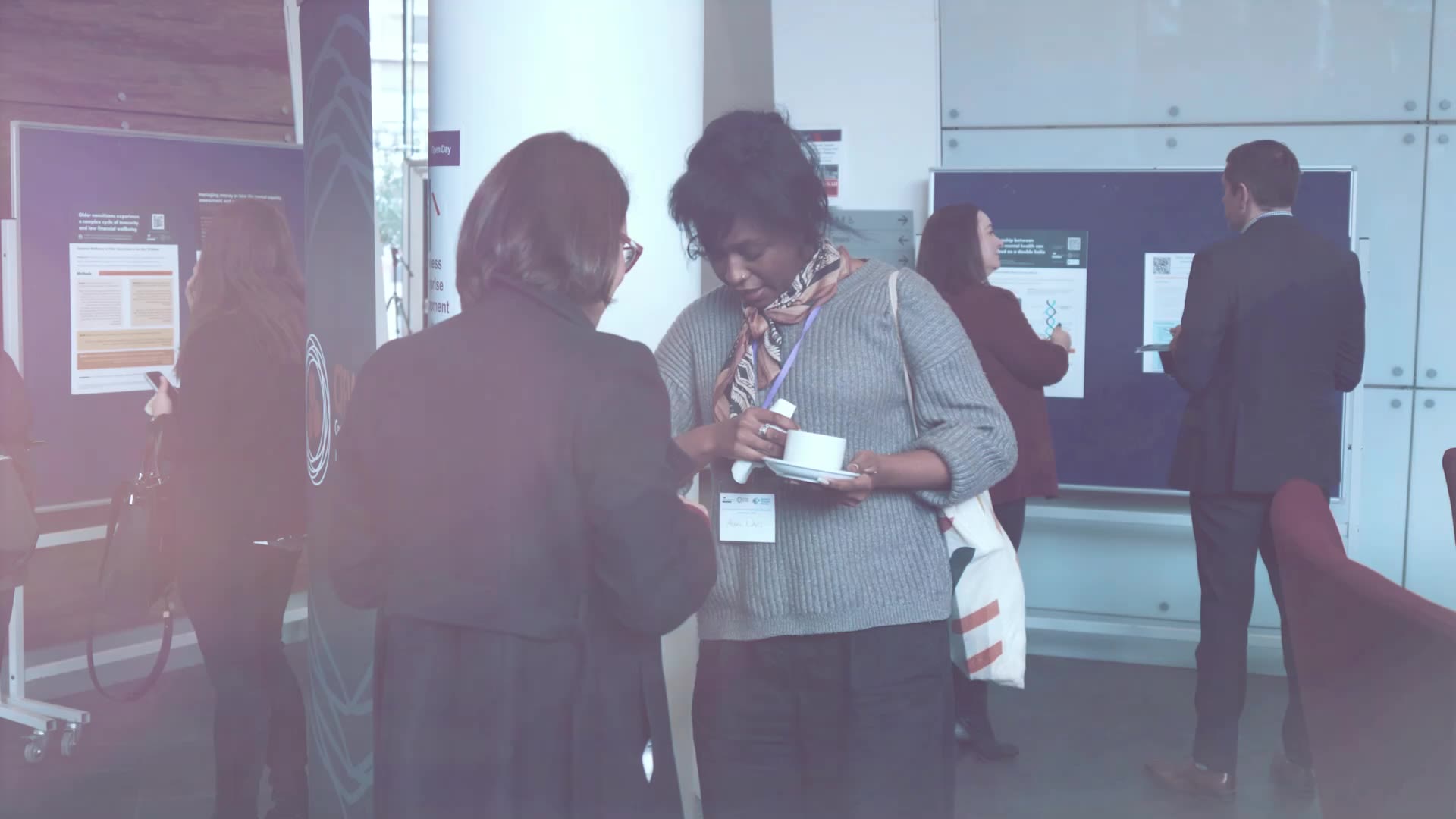

The Centre for Personal Financial Wellbeing has just celebrated its first anniversary having been launched at the first of its (now annual) Personal Financial Wellbeing Conferences in November 2022. However, I hope you will agree, as you read over our Annual Review for the 2023 year, it has achieved much in this limited time.

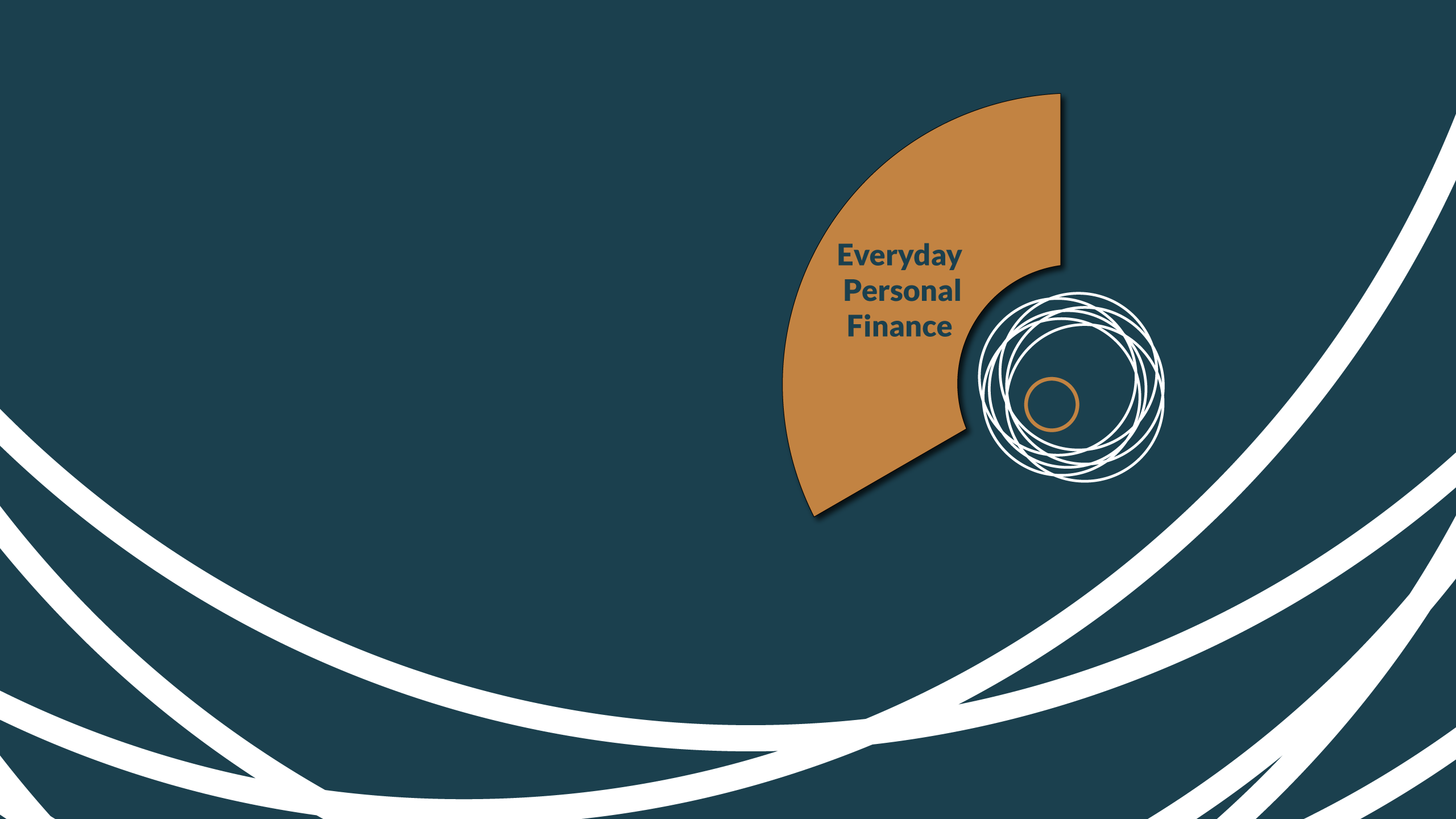

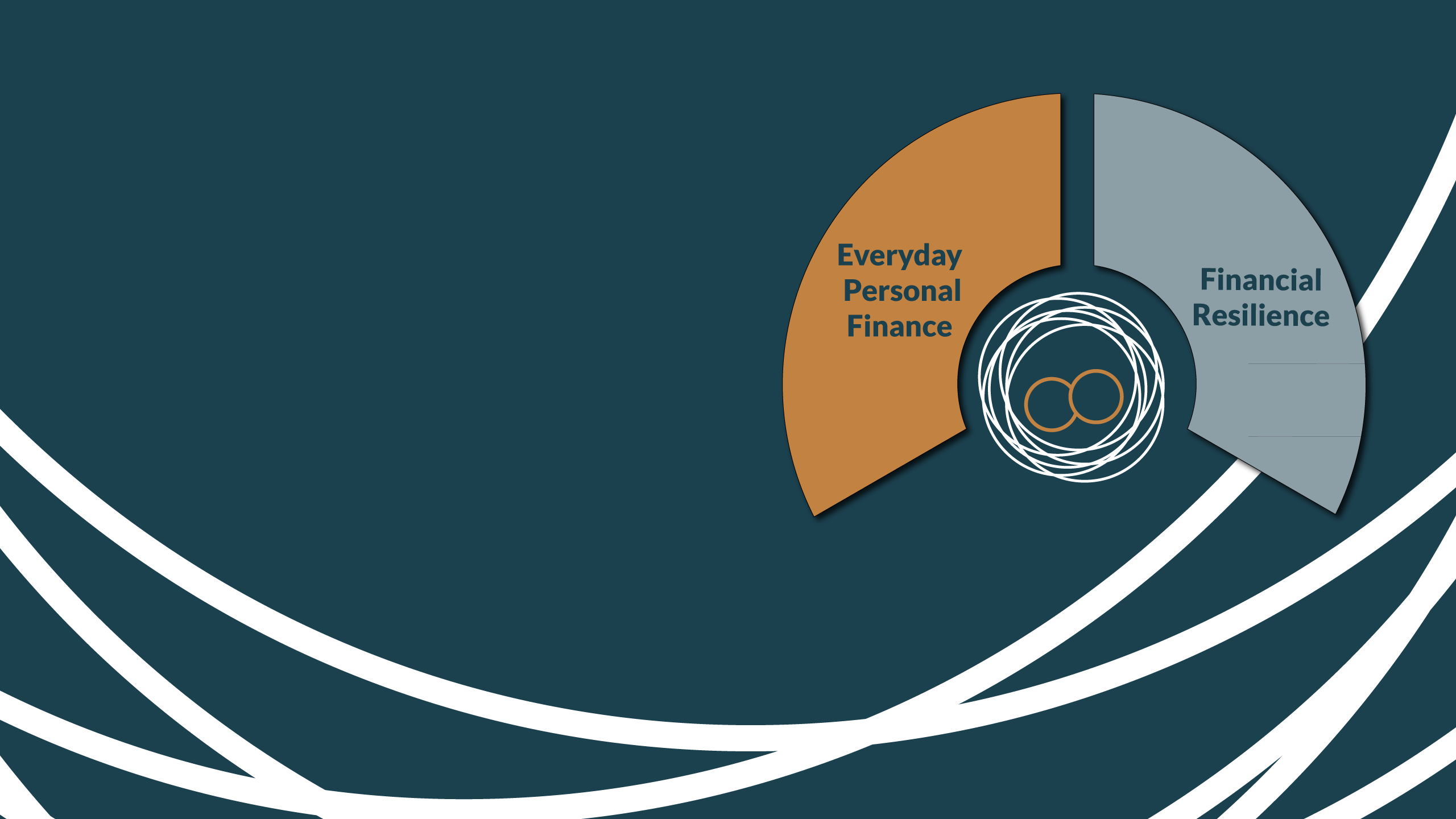

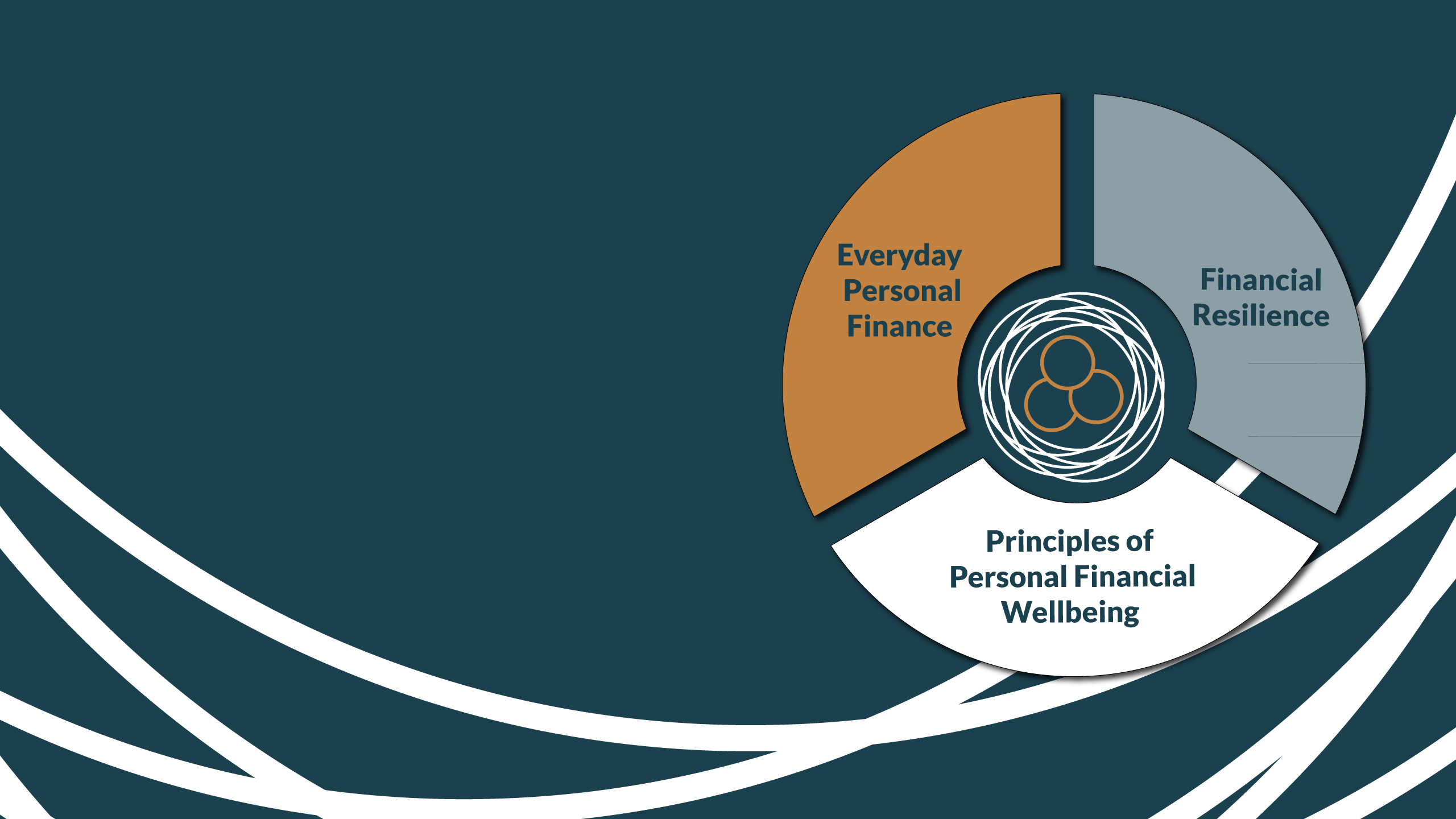

The Centre’s three key themes are detailed below. These represent really practical, as well as theory-led, ways in which we seek to make a difference with our work.

The Centre is now made up of 7 core members (Aston University employees mostly working within the Centre) and 12 Associate members – some of whom are based elsewhere within Aston University and some externally. An Associate member of the Centre has to be actively engaged with us to have and keep that status and we are delighted to be able to expand our activity by working with this excellent group of people (and some others) across the range of projects we have embarked on in this year. More details on who all of our team are, and what they are working on, can be found later in this review.

During the year we have delivered on several active projects and raised funds for new projects totalling more than £1million. The details of these projects can be found in the various sections of this review below. A full list of all completed and active projects is given in the last section – all with links to where you can find more details and access outputs from this work. We thank all our funders and partners linked to these projects for their support.

We believe this clearly shows that as a Centre, we are already ‘moving the dial’ in key ways in our target field after only a year of operation. Our plan for 2024 is to continue to create impact in all we do expressly seeking to make a practical difference with our work.

Another good way to get an overview of the Centre is to watch my Aston University Inaugural Lecture from February, entitled, ‘The Cost of Living Crisis – can research make any real difference?’ (link below) that details why, what and how we do what we do as a group.

I am enormously proud to be leading this group and know something of what is to come of course that we haven’t shared here. This involves really innovative and exciting projects and events already planned for 2024 that I look forward to sharing with you over the year.

If you’d like to engage with us do please reach out, join our socials and contribute to the discussions there, and of course do come and attend one of our events. We’d be delighted to hear from you and see you there.

Andy Lymer

Director of CPFW

Who we are

Our core team

The people behind the Centre for Personal Financial Wellbeing

Professor Andy Lymer

Centre Director and Professor of Taxation and Personal Finance

Key research areas

personal finance

taxation

social policy

small businesses

poverty alleviation

financial education

Dr Hayley James

Senior Research Fellow

Key research areas

household finance

pensions

gender and financial services

money and mental wellbeing

ageing societies

young people

Dr Rasha Kassem

Senior Lecturer in Accounting

Key research areas

fraud and individuals' wellbeing

fraud against individuals

COVID-19 and individuals' wellbeing

Dr Halima Sacranie

Research Fellow

Key research areas

housing and communities

social and affordable housing

gambling

financial inclusion

housing and neighbourhood quality

sustainability

Dr Lin Tian

Research Associate

Key research areas

household finance

financial inclusion

labour and health economics

deprivation and financial wellbeing

intergenerational transfer of wealth

energy literacy

Alexus Davis

Research Associate

Key research areas

household finance

financial inclusion

inequalities in care

sociology of health

creative methods

Dixon Wong

Centre Manager

Key duties

administration

website

social media

budgeting

events

liaison

Associate Members

Anne Angsten Clark

Lecturer in Design Thinking and Innovation, University of Bristol

Working with the Centre on the Real Accounts project.

Ariane Agunsoye

Senior Lecturer in Economics, Goldsmiths, University of London

Working with the Centre on gender and financial services.

Bernadene de Clercq

Professor, University of South Africa

Working with the Centre on financial literacy and wellbeing projects in South Africa.

Carla Hoppe

Founder at Wealthbrite

Working with the Centre on young adults and money skills.

David Hayes

Senior Lecturer, University of Bristol

Gary Burke

Associate Professor of Strategy and Organisation, University of Bristol Business School

Working with the Centre on poverty alleviation strategies.

Jo Phillips

Director of Research and Innovation, Nest Insight

Working with the Centre on the Real Accounts project.

Kanimozhi Narayanan

Lecturer in Organisational Behaviour

Working with the Centre on the financial effects of harmful gambling.

Katie Tonkiss

Senior Lecturer in Sociology and Policy

Working with the Centre on non-citizens and personal finance.

Ngoc Dieu Linh Vi

Lecturer in Economics

Working with the Centre on deprivation and financial wellbeing.

Olga Biosca

Professor of Economics, Glasgow Caledonian University

Working with the Centre on the Real Accounts project.

Omid Omidvar

Associate Professor, University of Warwick

Working with the Centre on poverty alleviation strategies.

Our Research Focus

Centre’s research is focussed around three key themes:

Everyday Personal Finance

Our research in this area explores how to achieve effective personal financial wellbeing for different parts of society. This includes: exploring how best to support people living on lower incomes, how to ‘decumulate’ wealth well into later life, the impact of being a migrant managing money, and decisions such as whether to be an employee or work for yourself.

Creating Financial Resilience

Our research in this area seeks to improve our understanding of how to balance spending and savings, over the short and longer terms, and how to facilitate the development of a ‘nation of savers’. We look at both common and alternative approaches to developing and maintaining saving strategies. Our work explores effective savings support for those on lower incomes and in precarious work, and those affected by migration and displacement.

Principles of Personal Financial Wellbeing

Our work also seeks to explore the underpinning and underlying principles of personal financial wellbeing. We examine issues such as how can financial wellbeing be best defined to enable its effective development in practical ways. We study how the results of change from different interventions can be measured and assessed reliably. We look at the implications of viewing financial wellbeing in different ways to aid it’s impact on people’s lives.

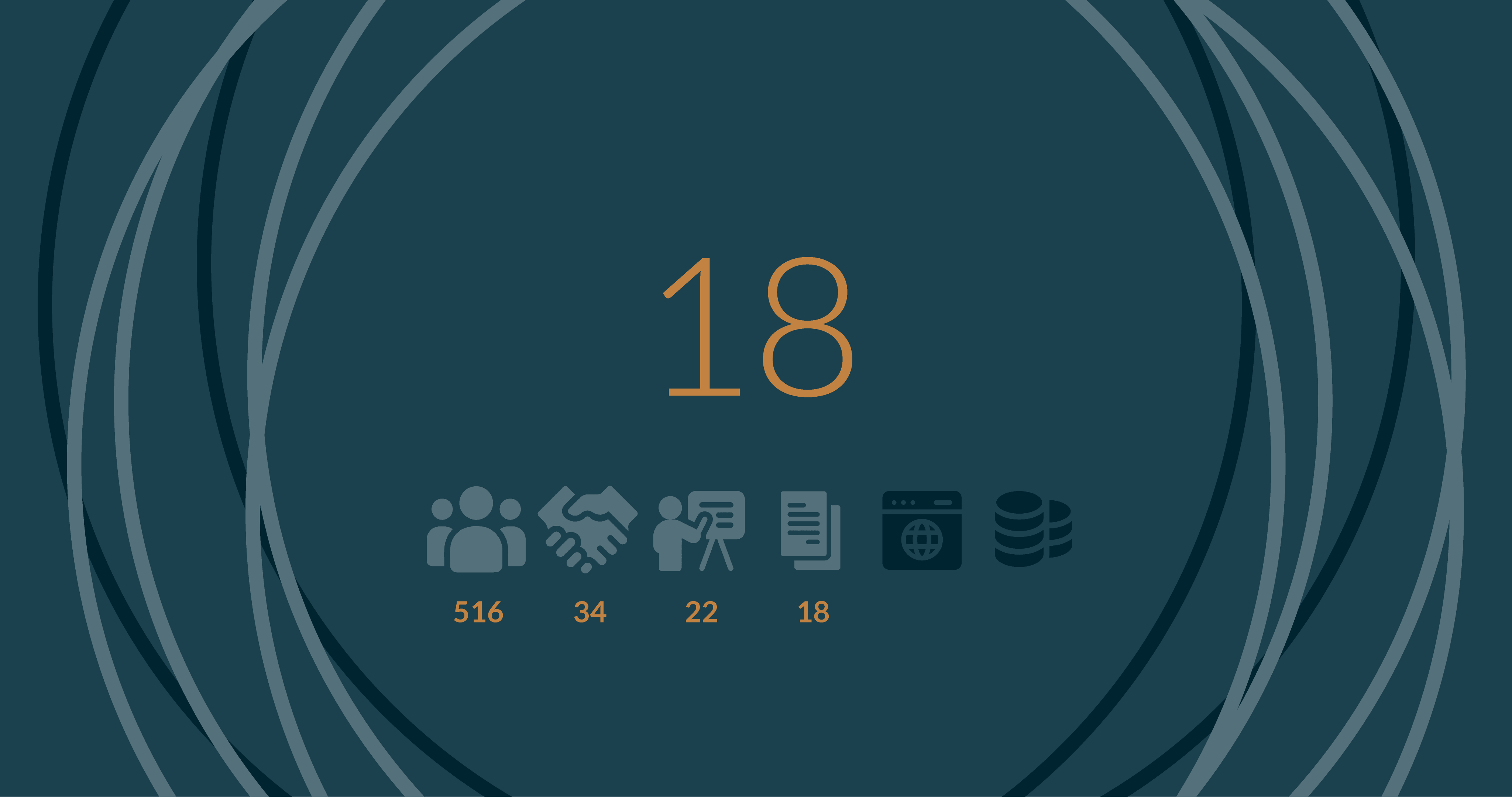

Our impacts in 2023

Number of people who

participated in our events in 2023

Number of organisations

we worked with in 2023

Number of events we

have presented at in 2023

Number of reports / research /

books published in 2023

Number of people we've

engaged with online in 2023

Total new funding raised

for active projects in 2023

What are we working on now?

Our events in 2023

Active projects

Real Accounts

Commenced in March 2023

Real Accounts is a longitudinal study of UK households’ financial lives that launched in spring 2023. It uses first-hand stories and digital transaction tracking to build an in-depth, in-the-moment understanding of households’ income, spending and money management strategies over time. The project is led by Nest Insight in collaboration with the Centre and Glasgow Caledonian University, with support from the Aviva Foundation.

At the moment, very little is known about how low- to moderate-income households across the country manage their money or the strategies they use to deal with changes to their income, the rising cost of living, and unexpected expenses that come up in day-to-day life. We’ll combine first-hand stories with real-time transaction information to build a picture of households’ experiences, decision making and diverse financial approaches.

See more details on the project here.

Team: Hayley James, Kris Fuzi, Alexus Davis and Andy Lymer

Regional Poverty Alleviation

January 2022 - July 2024

Following the Covid pandemic many regional and local government bodies have been looking at lessons learned over this period for how poverty alleviation approaches could be re-imagined. In this project we are working with Malvern Hills District Council and Birmingham City Council to aid the development of their regional poverty alleviation strategies utilising the principles and practices of addressing wicked challenges.

This project looks at how strategies are formed, how the wicked challenges are examined within the authorities themselves, and how they work in conjunction with their various public, voluntary/charity and third sectors partners. The two Councils aim at becoming exemplars of best practice in this area and this project will provide a toolkit for others to use – particularly in respect of how to partner effectively towards delivering solutions to problems that are proving very difficult to address.

This project is now entering its second year in autumn 2023.

See the First year report on our work with Malvern Hills District Council.

Partners:

Team: Andy Lymer, Gary Burke and Omid Tehrani

Financial Education in South Africa

Commenced in July 2023

The Centre is providing support to the South African Government's Financial Sector Conduct Authority (FSCA) to review their latest national financial wellbeing survey. This work will provide a segmentation analysis specifically seeking to help to address the most suitable mix of generic or more targeted financial education to create the most beneficial improvement in financial wellbeing across the country.

See more details on the project here.

Team: Bernadene de Clercq, Lin Tian and Andy Lymer

Supported by:

Gender and Financial Wellbeing

Commenced in 2023

Dr Hayley James is creating a book exploring the impact of gender on how people ‘do’ finance in the course of their everyday lives and how this shapes their financial wellbeing in the present and the future. This publication will be forthcoming in late 2024.

See more details on the project here.

Team:: Hayley James

SMEs and Financial Wellbeing

HOT OFF THE PRESS

The Centre will be commencing a new, large scale, 2 year project in early 2024 working with Aston Centre for Research in Ethnic Minority Entrepreneurship (CREME), the Centre for Business in Society (CBiS) based at Coventry University and Citizens UK.

The project will be looking into the myriad of ways in which ethnic minority-led businesses make decisions about their finances that enable them to launch well and survive to steady state. It will specifically focus on the often complex interactions between personal/household finances and entrepreneurial business financing needs.

More on this exciting project will be announced in early 2024.

Partners:

Appendix: list of projects

Contact us